The Basics of Saving and Budgeting

Objective

Students will be able to:

- Make informed decisions about how to save more and consume less.

Standards

In this personal finance lesson, students will identify ways to spend and save to learn how to reach financial goals.

Procedure

Warm-Up

Ask students to list the ways ordinary people can spend less and save more. On the board, create two lists:

- Ways to Spend Less

- Ways to Save More

Place a mark next to any of items students repeat.

Modeling

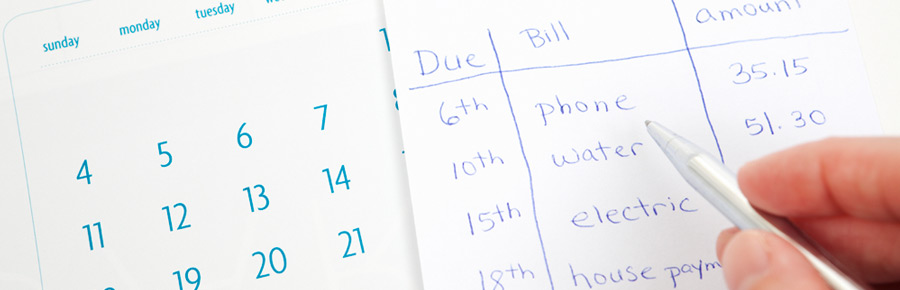

Begin by defining a budget. A budget is a spending-and-savings plan, based on estimated income and expenses for an individual or an organization, covering a specific time period. Tell students a good budget requires them to make informed choices about their future income and spending habits. Explain that this lesson will involve some basic choices about every day purchases.

Place the following list on the board: (1) a smart phone with a full data plan or pay-as-you-go plan*; (2) buy a new car with an auto loan paying interest, pay cash for a used car, or rely on public transportation* to get to and from places: (3) eat a full meal at home* or dine out at a full service restaurant; (4) rent an apartment with one roommate* or own a house at twice the expense; (5) have a child while single or married*; and (6) start setting aside investment funds for retirement at the age of 22* or wait until age 32 with the goal of reaching $1 million dollars in retirement funds.

Ask students to evaluate the sets of items, and determine which item in each statement will help them save more and spend less. For example, ask students to compare the total annual cost of purchasing a smart phone with a full data plan to the pay-as-you-go plan. Once they have made their selections, have them explain how choosing that item will release funds for savings if the more expensive one is already in a household budget.

Circle the least expensive items: (1) pay-as-you-go phone; (2) public transportation (or used car); (3) eat in; (4) rent an apartment with a roommate; (5) have a child while married and share the expenses and responsibilities; (6) start shifting funds into investments early, put the power of compound interest to work for you, and earn retirement income to spend and save in the future. Have students react to the answers. Accept a variety of responses with respect to the various items in these lists. (Item 6 will likely challenge students who do not consider the funds invested today are available for future spending and saving, on average.)

Distribute The Basics of Saving and Budgeting to each student. Watch the video Better Money Habits: Steps to Better Money Management. Have students complete the Handout as a guide while viewing the video. After viewing the video, review the handout with the class and use the The Basics of Saving and Budgeting Answer Key to review the answers.

Explain that having a sound spending and savings plan lays out the steps needed to reach their financial goals. Remind them these plans can also help them gain financial stability and personal independence with little worry or concern about paying upcoming bills and paying down debt.

Group Activity

Organize students in groups. Ask them to do an internet search and identify three (3) or more creative steps people have taken in order to successfully achieve two financial goals – (1) spending less and (2) saving more. Explain that these steps should be taken together to achieve financial security. Decreased consumption or spending should be matched with increased savings, assuming there is no underlying debt to pay off. Have representatives from each group describe the strategizes identified in their groups.

Individual Activity

Distribute “Individual Activity Handout 4.2”. Read the quotes about goals at the top of the handout. Ask students to describe why documenting goals by writing them down is important. Have students describe the steps they would take to reach a short-term goal of spending less in order to save more. Have them complete the rest of the activity.

Allow students sufficient class time to complete the handout. After students have stated their goals and described steps they will take to achieve them, ask for student volunteers to share their goals and plans. Conclude by asking students to share what they have learned.

(NOTE: There is no answer key but student response should (1) identify ways to reduce spending in order to save more and (2) connect an increase in savings to less consumption, not new money or income.)

Assessment

Go back to the warm-up results. Ask students to combine that list with the new items they discovered in their group research. Ask them to take the two lists and match strategies that reduce consumptions with strategies that increase savings. Have them explain how financial security can result when people elect to consume less in favor of saving more. Make sure they understand that all of this can be accomplished without new funds coming into a household budget.

Extension

Activity 1

Watch EconLowDown “Episode 1 – Growing Money – Compound Interest” with Discussion Questions

Activity 2

View other related Better Money Habits videos including:

- How to Save Money Every Day

- 5 steps to get started with saving

- Creating a Safety Net for Life’s Unexpected Events

- Easy Ways to Save on Everyday Expenses